Home · Book Reports · 2024 · The Millionaire Fastlane

- Author :: MJ DeMarco

- Publication Year :: 2011

- Source :: Millionaire_Fastlane.pdf

designates my notes. / designates important. / designates very important.

- Page numbers from the pdf.

Table of Contents

- 00: Introduction

- 01: The Great Deception

- 02: How I Screwed "Get Rich Slow"

- 03: The Road Trip to Wealth

- 04: The Roadmaps to Wealth

- 05: The Sidewalk Roadmap

- 06: Has Your Wealth Been Toxified?

- 07: Misuse Money and Money Will Misuse You

- 08: Lucky Bastards Play the Game!

- 09: Wealth Demands Accountability

- 10: The Lie You've Been Sold: The Slowlane

- 11: The Criminal Trade: Your Job

- 12: The Slowlane: Why You Aren't Rich

- 13: The Futile Fight: Education

- 14: The Hypocrisy of the Gurus

- 15: Slowlane Victory ... A Gamble of Hope

- 16: Wealth's Shortcut: The Fastlane

- 17: Switch Teams and Playbooks

- 18: How the Rich Really Get Rich!

- 19: Divorce Wealth from Time

- 20: Recruit Your Army of Freedom Fighters

- 21: The Real Law of Wealth

- 22: Own Yourself First

- 23: Life's Steering Wheel

- 24: Wipe Your Windshield Your Clean

- 25: Deodorize Flatulent Headwinds

- 26: Your Primordial Fuel: Time

- 27: Change That Dirty, Stale Oil

- 28: Hit The Redline

- 29: The Right Road Routes to Wealth

- 30: The Commandment of Need

- 31: The Commandment of Entry

- 32: The Commandment of Control

- 33: The Commandment of Scale

- 34: The Commandment of Time

- 35: 35 - Rapid Wealth: The Inter

- 36: Find Your Open Road

- 37: Give Your Road a Destination!

- 38: 38 - The Speed of S

- 39: Burn The Business Plan, Ignite Execution!

- 40: Pedestrians Will Make You Rich!

- 41: Throw Hijackers to the Curb!

- 42: Be Someone's Savior

- 43: Build Brands, Not Businesses

- 44: Choose Monogamy Over Polygamy

- 45: Put It Together: Supercharge Your Wealth Plan

Part 1: Wealth in a Wheelchair … “Get Rich Slow” is Get Rich Old

Part 2: Wealth is Not a Road, But a Road Trip

Part 3: The Road Most Traveled: The Sidewalk

Part 4 - Mediocrity: The Slowlane Road

Part 5: Wealth: The Fastlane Roadmap

Part 6: Your Vehicle to Wealth: YOU

Part 7: The Roads to Wealth

Part 8: Your Speed: Accelerate Wealth

· Introduction

page 011:

- It’s financial mediocrity, known as “Get Rich Slow,” “The Slowlane,” or “Wealth in a Wheelchair.” That tedium sounds like this: Go to school, get good grades, graduate, get a good job, save 10%, invest in the stock market, max your 401(k), slash your credit cards, and clip coupons . . . then, someday, when you are, oh, 65 years old, you will be rich.

page 012:

-

If you aren’t wealthy, STOP doing what you’re doing. STOP following the conventional wisdom.

-

Your today is yesterday’s consequences. Your yesterday laid the foundation for today. Your beliefs and the actions triggered from those beliefs have delivered you to your today, your now, and your life. If you’re not happy in your life now, it’s time to STOP and reflect on the road you’re traveling and how you got there—and then change roads.

page 014:

- I don’t claim the Fastlane is easy; it’s hard work. If you expect a four-hour workweek here, you will be disappointed.

Part 1: Wealth in a Wheelchair … “Get Rich Slow” is Get Rich Old

· Chapter 01 - The Great Deception

page 019:

- Nonetheless, the preordained plan continues to wield power, recommended and enforced by a legion of hypocritical “financial experts” who aren’t rich by their own advice, but by their own Millionaire Fastlane. The Slowlane prognosticators know something that they aren’t telling you: What they teach doesn’t work, but selling it does.

· Chapter 02 - How I Screwed “Get Rich Slow”

- From dead-end jobs to moving and trying. Built a website that had a little income. Sold it during dot-com boom. Bought it back in the bust. Built it to super success. Spent 60 hour weeks making it all work and then bingo, real money.

Part 2: Wealth is Not a Road, But a Road Trip

· Chapter 03 - The Road Trip to Wealth

page 036:

-

Wealth eludes most people because they are preoccupied with events while disregarding process. Without process, there is no event.

-

Process makes millionaires, and the events you see and hear are the results of that process. For our chef, the cooking is the process, while the meal is the event.

· Chapter 04 - The Roadmaps to Wealth

page 040:

- If you want to change your life, change your choices. To change your choices you must change your belief system. Your belief system is defined by your roadmap.

page 042:

-

Each roadmap contains key mindsets that act as signposts, or “mindposts,” that provide direction and guide actions, just like a roadmap. Those mindposts are:

-

Debt Perception:

- Does debt control you or do you control your debt?

-

Time Perception:

- How is your time valued and treated? Abundant? Fleeting? Inconsequential?

-

Education Perception:

- What role does education have in your life?

-

Money Perception:

- What is money’s role in your life? Is money a tool or a toy? Plentiful or scarce?

-

Primary Income Source:

- What is your primary means of creating income?

-

Primary Wealth Accelerator:

- How are you accelerating your net worth and creating wealth? Or are you?

-

Wealth Perception:

- How do you define wealth?

-

Wealth Equation:

- What is your mathematical plan for accumulating wealth? What wealth equation defines the physics of your wealth universe?

-

Destination:

- Is there a destination? If so, what does it look like?

-

Responsibility & Control:

- Are you in control of your life and your financial plan?

-

Life Perception:

- How do you live your life? Do you plan for the future? Forsake today for tomorrow? Or tomorrow for today?

Part 3: The Road Most Traveled: The Sidewalk

· Chapter 05 - The Sidewalk Roadmap

page 052:

- Notice how both income-poor and income-rich Sidewalkers share the same problems but different scenery. The reason is, more money is not a solution to poor financial management.

· Chapter 06 - Has Your Wealth Been Toxified?

page 057:

- Wealth is authored by strong familial relationships, fitness and health, and freedom— not by material possessions.

· Chapter 07 - Misuse Money and Money Will Misuse You

page 059:

- If we are too busy chasing the next greatest gadget to strike down the competitive opulence of the Joneses, we finance our misery. The World Value Survey concluded that “consumerism” is the leading obstacle to happiness.

page 063:

-

Money doesn’t buy happiness because money is used for consumer pursuits destructive to freedom. Anything destructive to freedom is destructive to the wealth trinity.

-

Money, properly used, can buy freedom, which can lead to happiness.

-

Happiness stems from good health, freedom, and strong interpersonal relationships, not necessarily money.

-

Lifestyle Servitude steals freedom, and what steals freedom, steals wealth.

-

If you think you can afford it, you can’t.

-

The consequence of instant gratification is the destruction of freedom, health, and choice.

· Chapter 08 - Lucky Bastards Play the Game!

page 065:

-

Process creates events that others see as luck. He goes on to comment how nobody mentioned luck when it came time to reading complicated software texts or Cisco router manuals or sitting in his house testing and experimenting with new technologies. Where was luck then?

-

Luck occurs when probability moves from impossible to likely.

page 067:

- The infomercial guru knows exactly what he’s doing. He targets Sidewalkers, who are magnetized to events and the big hit. Why advertise at 2 a.m.? That’s when Sidewalkers congregate, because they’re either unemployed or watching reruns of Seinfeld. Believe me, Fastlane drivers aren’t up at 2 a.m. because of some boob tube rerun; they’re forging process and muscling toward their destination.

· Chapter 09 - Wealth Demands Accountability

page 069:

- One anchor to the Sidewalk is to entrust your financial plan to others, to believe that there is a chauffeur to wealth and that someone else can drive that journey for you. This mindset makes you vulnerable to victimhood.

Part 4 - Mediocrity: The Slowlane Roadmap

· Chapter 10 - The Lie You’ve Been Sold: The Slowlane

page 078:

-

Debt Perception:

- Debt is evil. It must be religiously attacked, even if that means working overtime for life.

-

Time Perception:

- My time is abundant and I will gladly trade my time for more dollars. The more hours I can work, the more I can pay off my debt and save money for retirement at 65.

-

Education Perception:

- Education is important because it helps me earn a bigger salary.

-

Money Perception:

- Money is scarce and every dime and dollar must be accounted for, budgeted, and perilously saved. If I want to retire by 65 with millions, I have to ensure I don’t squander my hard-earned money.

-

Primary Income Source:

- My job is my sole source of income.

-

Primary Wealth Accelerator:

- Compound interest is powerful because $10 invested today will be worth $300,000 in 50 years. Oh yes, and don’t forget about mutual funds, home appreciation, and my employer’s 401(k).

-

Wealth Perception:

- Work, save, and invest. Work, save, and invest. Repeat for 40 years until retirement age . . . 65 years old or, if I’m lucky and the markets return 12% yearly, maybe 55!

-

Wealth Equation:

- Wealth = job + market investments.

-

Destination:

- A comfortable retirement in my twilight years.

-

Responsibility & Control:

- It’s my responsibility to provide for my family although for that plan to work I have to rely on others, including my employer, my financial adviser, the government, and a good economy.

-

Life Perception:

- Settle for less. Give up on big dreams. Save, live frugal, don’t take unnecessary risks, and one day I will retire with millions.

· Chapter 11 - The Criminal Trade: Your Job

· Chapter 12 - The Slowlane: Why You Aren’t Rich

· Chapter 13 - The Futile Fight: Education

page 102:

-

The second educational entrapment danger is “education servitude.” While the Sidewalker deals with “Lifestyle Servitude,” the Slowlaner wrestles with “Education Servitude” (freedom eroded by education) that traps the victim to a job.

-

A survey of college borrowers found that the average college senior graduated with nearly $19,000 in student loan debts, and graduate degree pursuers more than $45,000. A 2007 Charles Schwab survey revealed that teenagers believe when they get older they will earn an average salary of $145,000. The reality? Adults with a college degree earned an average of $54,000.

-

Slowlaners attempt to manipulate intrinsic value by education.

· Chapter 14 - The Hypocrisy of the Gurus

page 104:

- The Paradox of Practice asks, “Do you practice what you preach? Are you a model, an exemplification of what you teach?”

page 108:

- Many money gurus often suffer from a Paradox of Practice; they teach one wealth equation while getting rich in another. They’re not rich from their own teachings.

· Chapter 15 - Slowlane Victory … A Gamble of Hope

page 112:

-

Slowlane gurus praise this strategy. The edicts are clear: Pay down your debt. Dump the new car for an old one. Raise your insurance deductibles. Cancel your credit cards and pay cash for everything. Quit buying $10 coffee at Starbucks. Bag your lunch. Shop in bulk. Spend four hours clipping coupons. C’mon buddy, slash those expenses—some day you’re going to be rich! Hilarious!

-

These tiresome strategies are a classic response to being stuck in the Slowlane.

page 113:

-

Hoodwinking expenses does not create wealth. You can’t win the money game always playing defense—you must go on offense. Exploding income and controlling expenses creates wealth.

-

So what happens when a Slowlaner commits to the expense variable? Life becomes about what you can’t do. You can’t buy that coffee. You can’t take that trip.

-

In a 2002 AARP (formerly the American Association of Retired Persons) survey, 69% of the respondents said they would need to work past retirement age. A year earlier, 45% said they would need to work into their 70s and 80s. We can deduce something disturbing from this data: The Slowlane’s failure rate is near 70%.

page 116:

-

12 DISTINCTIONS BETWEEN SLOWLANE AND FASTLANE MILLIONAIRES

-

Slowlane millionaires make millions in 30 years or more. Fastlane millionaires make millions in 10 years or less.

-

Slowlane millionaires need to live in middle-class homes. Fastlane millionaires can live in luxury estates.

-

Slowlane millionaires have MBAs. Fastlane millionaires hire people with MBAs.

-

Slowlane millionaires let their assets drift by market forces. Fastlane millionaires control their assets and possess the power to manipulate their value.

-

Slowlane millionaires can’t afford exotic cars. Fastlane millionaires can afford to drive whatever they want.

-

Slowlane millionaires work for their time. Fastlane millionaires have time working for them.

-

Slowlane millionaires are employees. Fastlane millionaires hire employees.

-

Slowlane millionaires have 401(k)s. Fastlane millionaires offer 401(k)s.

-

Slowlane millionaires use mutual funds and the stock market to get rich. Fastlane millionaires use them to stay rich.

-

Slowlane millionaires let other people control their income streams. Fastlane millionaires control their income streams.

-

Slowlane millionaires are cheap with money. Fastlane millionaires are cheap with time.

-

Slowlane millionaires use their house for net worth. Fastlane millionaires use their house for residency.

Part 5: Wealth: The Fastlane Roadmap

· Chapter 16 - Wealth’s Shortcut: The Fastlane

page 121:

-

mindposts or behavioral characteristics that drive the Fastlaner’s actions along the journey. They are:

-

Debt Perception:

- Debt is useful if it allows me to build and grow my system.

-

Time Perception:

- Time is the most important asset I have, far exceeding money.

-

Education Perception:

- The moment you stop learning is the moment you stop growing. Constant expansion of my knowledge and awareness is critical to my journey.

-

Money Perception:

- Money is everywhere, and it’s extremely abundant. Money is a reflection of how many lives I’ve touched. Money reflects the value I’ve created.

-

Primary Income Source:

- I earn income via my business systems and investments.

-

Primary Wealth Accelerator:

- I make something from nothing. I give birth to assets and make them valuable to the marketplace. Other times, I take existing assets and add value to them.

-

Wealth Perception:

- Build business systems for cash flow and asset valuation.

-

Wealth Equation:

- Wealth = Net Profit + Asset Value

-

Strategy:

- The more I help, the richer I become in time, money, and personal fulfillment.

-

Destination:

- Lifetime passive income, either through business or investments.

-

Responsibility & Control:

- Life is what I make it. My financial plan is entirely my responsibility and I choose how I react to my circumstances.

-

Life Perception:

- My dreams are worth pursuing no matter how outlandish, and I understand that it will take money to make some of those dreams real.

· Chapter 17 - Switch Teams and Playbooks

page 129:

-

From the day you were born, you were baptized to play for Team Consumer, from the Barbie Doll and the Tonka Truck to the Star Wars action figures. You’ve been conditioned to demand: to want products, to need products, to buy products, and of course, to seek out the cheapest of those products.

-

The correlation between the Slowlane and the Sidewalk is this: Jobs exist to facilitate the consumer process.

-

The winning team is Team Producer. Reshape life’s focus on producing, not consuming.

· Chapter 18 - How the Rich Really Get Rich!

page 140:

- The key to the Fastlane wealth equation is to have a high speed limit, or an unlimited range of values for units sold. This creates leverage. The market for your product or service determines your upper limit.

page 141:

-

The primary wealth accelerant for the rich is asset value, defined as appreciable assets created, founded, or bought.

-

Wealth creation via asset value is accelerated by each industry’s average multiplier. For every dollar in net income realized, the asset value multiplies by a factor of the multiple.

-

Your industry of specialization will determine the average multiple that determines your wealth accelerant factor. If the multiple is 3, your WAF is 300%.

-

Liquidation events transform appreciated assets (“paper” net worth) into money (“real” net worth) that can be transformed into another passive income stream: a money system.

· Chapter 19 - Divorce Wealth from Time

page 144:

-

There are five business seedlings to money trees. Mind you, these aren’t absolute and they interbreed with each other. Each system inherently has a grade that rates its level of passivity. A higher grade means a greater potential for passivity, but not necessarily a greater income.

- Rental Systems

- Computer/Software Systems

- Content Systems

- Distribution Systems

- Human Resource Systems

page 145:

- Photographers can earn licensing revenues by allowing others to use their photos.

page 147:

- When inventing any product, the invention is always half the battle. Distribution is the other. The greatest product in the world goes unused if it isn’t leveraged into the proper distribution system—either one that exists, or one that you create.

page 148:

- While I would have made more money hiring more people, I wasn’t willing to forgo my free time for it.

page 149:

- However don’t let that scare you. If you want to make millions of dollars, or billions, human resource systems are needed, because you can’t do everything yourself.

· Chapter 20 - Recruit Your Army of Freedom Fighters

page 151:

- Savers are winners because they eventually become lenders. Savers are winners because they become owners in companies. Savers are winners because they become producers and build assets.

page 153:

- Compound interest pays my bills. It’s my tool. It’s my passive income source. Yet, compound interest is not responsible for my wealth. This is critical. Fastlaners aren’t using compound interest to build wealth, because it’s not in their wealth equation. The heavy lifting of wealth creation is left to their Fastlane business.

· Chapter 21 - The Real Law of Wealth

- Touch millions of lives and make a small profit on each or sell something very expensive to few.

10. Part 6: Your Vehicle to Wealth: YOU

· Chapter 22 - Own Yourself First

page 166:

- You can’t pay yourself first if you don’t own yourself. Your vehicle (you) must be free and clear. When you have a job, someone owns you. And when someone owns you, you aren’t paid first, but last.

· Chapter 23 - Life’s Steering Wheel

page 170:

-

If you aren’t where you want to be, the problem is your choices.

-

The point of this dissertation is that Fastlane success isn’t one choice. It’s hundreds. And when you line a string of choices together, they create your process, and your process will create your lifestyle. Lifestyle choices will make you a millionaire.

page 174:

- Full of testosterone, cocky, and invincible, a 15-year-old kid with no motorcycle experience gambled with his life. I crashed on a dirt road going 50 miles per hour and broke my wrist and two fingers, lost nerves in my knee, and screwed up my neck. While the bones healed, the full array of consequences from that day has not dissipated. Decades later I live with chronic neck pain and have to sleep in unorthodox positions to avoid discomfort. I’ve spent countless hours and money on physical therapy and chiropractic treatments.

· Chapter 24 - Wipe Your Windshield Your Clean

page 181:

- The first decision tool is Worst Case Consequence Analysis (WCCA), which requires you to become forward-thinking and an analyzer of potential consequences. WCCA asks you to answer three questions about every decision of consequence:

- What is the worst-case consequence of this choice?

- What is the probability of this outcome?

- Is this an acceptable risk?

10.3.2. 183:

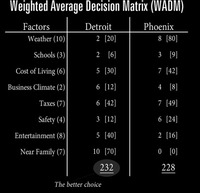

- next to each decision factor, weigh its importance to the decision from 1 through 10, with 10 being the most important. For example, you are seasonally depressed, so weather is assigned a 10 in your matrix. Subsequently, your children are almost 18 so you decide that a good school system isn’t a top priority and it receives a 3.

page 184:

- After each criterion is ranked 1 through 10, grade each choice 1 through 10 for each decision factor. The school system in Detroit? You give it a 4. In Phoenix, you give the school system a 5, as you determine it is slightly better.

page 185:

- Next, for each row, multiply the weight times the grade and put that number next to the grade in parentheses. For example, in the entertainment row, Detroit receives a 40 (8 weight X 5 grade), while Phoenix receives a 16 (8 weight X 2 grade).

page 186:

- The final step is simply to add up the graded weight columns to get a final number for each choice.

page 187:

187_weighted_average_decision_matrix.jpg

· Chapter 25 - Deodorize Flatulent Headwinds

- Basically, you are the average of the 5 people you spend the most time with.

· Chapter 26 - Your Primordial Fuel: Time

page 196:

- The average American watches more than four hours of TV each day. In a 65-year life, that person will have spent nine years glued to the tube.

page 197:

- time is deathly scarce, while money is richly abundant.

page 199:

- Law of Chocolate Chip Cookies: If the cookies don’t get into the grocery cart, they don’t get home. And if they don’t get home, they don’t get in my mouth. And if they don’t get in my mouth, they don’t transform into belly fat.

page 200:

-

Then why do so few get rich while the rest wallow from paycheck to paycheck? The distinction lies in the valuation of free time, the chosen roadmap, and the acquisition of parasitic debt. Guess the behaviors—rich or poor?

- This person sleeps until noon.

- This person watches hours of reality TV.

- This person drives two hours to save $20.

- This person buys airline tickets with multiple layovers to save $100.

- This person spends hours surfing social networks and gossip blogs.

- This person is a Level 10 Druid in World of Warcraft.

- This person watches every Chicago Cubs game (just kidding, all you loyal Cubs fans).

page 201:

- Fastlaners are frugal with time, while Slowlaners are frugal with money.

· Chapter 27 - Change That Dirty, Stale Oil

page 202:

- Unfortunately, graduation traditionally signals the end of education. Regardless of your graduating age, adulthood begins. The party is over and real life begins. To cease learning at graduation is wealth suicide.

page 203:

- You’re not a cog in the wheel; you learn to build the wheel.

page 208:

-

I saw a picture the other day of a student publicly protesting one of the government financial bailouts. She hoisted a large placard that read: “I’ve got a 4.0 GPA, $90,000 in debt and no job—where’s my bailout?” Where’s your bailout? Let me tell ya, walk into the bathroom, flip on the light-switch and look in the freaking mirror.

-

I strongly disagree with him on this point. While I don’t think she should get a bailout, I think NO ONE should get a bailout. It is either bailouts for everyone or bailouts for no one.

· Chapter 28 - Hit The Redline

- Tomorrow will never come. Do it today. Opportunity rarely comes at the right time. Take advantage when you can. Be committed, not interested.

11. Part 7: The Roads to Wealth

· Chapter 29 - The Right Road Routes to Wealth

page 221:

- Five Fastlane Commandments (NECST, pronounced “next”).

- The Commandment of Need

- The Commandment of Entry

- The Commandment of Control

- The Commandment of Scale

- The Commandment of Time

· Chapter 30 - The Commandment of Need

page 224:

- Never start a business just to make money. Stop chasing money and start chasing needs.

page 230:

- …your love becomes vulnerable to contamination when you do it for money. If you are forced to do anything, even something you purport to love, in exchange for a paycheck, that love is put in danger.

· Chapter 31 - The Commandment of Entry

page 236:

- The Commandment of Entry states that as entry barriers to any business road fall, or lessen, the effectiveness of that road declines while competition in that field subsequently strengthens.

· Chapter 32 - The Commandment of Control

page 241:

- Fastlane drivers retain control. Those who violate the commandment do not.

- Drivers create MLM companies; they don’t join them.

- Drivers sell franchises; they don’t buy them.

- Drivers offer affiliate programs; they don’t join them.

- Drivers run hedge funds; they don’t invest in them.

- Drivers sell stock; they don’t buy stock.

- Drivers offer drop-shipping; they don’t use drop-shipping.

- Drivers offer employment; they don’t get employed.

- Drivers accept rents and royalties; they don’t pay rents and royalties.

- Drivers sell licenses; they don’t buy them.

- Drivers sell IPO shares; they don’t buy them.

page 243:

- Think manufacture, not retail.

· Chapter 33 - The Commandment of Scale

page 248:

- There are six business habitats:

- Local/community (pool)

- County/city (pond)

- Statewide (lagoon)

- Regional (lake)

- National (sea)

- Worldwide (ocean)

page 249:

- Mark Cuban recently wrote on his blog that it doesn’t matter how many times you strike out in business because you only have to be right once, and that “once” can set you up for life. In other words, be in the business of home runs.

· Chapter 34 - The Commandment of Time

page 255:

- The Commandment of Time asks:

- Can this business be automated and systematized to operate while I’m absent?

- Are my margins thick enough to hire human resource seedlings?

- Can my operation benefit from the introduction of a money tree seedling?

- How can I get this business to operate exclusive of my time?

page 256:

- Would you rather work 10 hours a week and earn $60,000, or work 70 hours a week for $140,000? I’d take the former over the latter every time.

· Chapter 35 - Rapid Wealth: The Interstates

page 262:

-

Innovation covers any act of creation followed by distribution. Let me repeat that: Innovation involves two acts: 1) Manufacture and 2) Distribution.

-

Inventing isn’t really about inventing the vehicle, the telephone, or the goofy Segway—the core activity of inventors is just taking something and improving or modifying it.

page 263:

-

Innovation is a dual challenged process: manufacture and distribution. Inventing a product that solves a need is half the battle; the other half is getting your invention into the hands of millions, which involves a variety of distribution channels: infomercial (sell via mass media), retail (sell to distributors and wholesalers), and direct marketing (sell via print media, postal mail, Internet).

-

manufacture is one tiny battle in a larger war. Distribution is where the war is won.

· Chapter 36 - Find Your Open Road

page 265:

- Opportunity is rarely about some blockbuster breakthrough like the light bulb or the car, but as simple as an unmet need, or a need not met adequately. Opportunity is a solution to an inconvenience. Opportunity is simplification. Opportunity is a feeling. Opportunity is comfort. Opportunity is better service. Opportunity is fixing pain. Opportunity is putting weak companies out of business.

· Chapter 37 - Give Your Road a Destination!

page 274:

- Get started today by looking three feet in front of you, not three miles. A long gaze at the mountain crest will overwhelm you, so stop looking at it. The key to achieving enormous tasks is to break them down into their smallest parts. You can’t run a 26-mile marathon by focusing on the 26th mile. You attack the first, then the second, third, and so forth.

12. Part 8: Your Speed: Accelerate Wealth

· Chapter 38 - The Speed of Success

page 283:

- No, I won’t sign your NDA, nor do I care about your idea. In the world of wealth, ideas are worthless yet treated like gold.

· Chapter 39 - Burn The Business Plan, Ignite Execution!

· Chapter 40 - Pedestrians Will Make You Rich!

page 289:

-

my black book wasn’t a treasure trove of telephone numbers from female hotties but a written record of all complaints, grievances, and issues my business experienced daily. This book has served as my guide for over a decade.

-

I logged my customers’ complaints because they provided a kaleidoscope into the mind of my customers. One complaint meant there were 10 others who felt the same way. When my black book accumulated similar complaints weekly, I had to evaluate the issue and take corrective action.

page 296:

-

My repeated, and often preached, motto to my employees was, “The customer pays your paycheck, not me—keep them happy.”

-

who is listed on my Web site as my chief technology officer? Mark Cegraves. Oh, and look who’s my web developer—Gretchen Hankerson! Wow, so did I hire my friends from high school? No, I didn’t, especially since their names were just mere illusions of the real people. None of these people worked for me. Yet if you visited my Web site’s “Contact” or “About Us” page, they were listed as employees in high profile positions: CTO, business development, or Web producer. These people weren’t employees, but it looked like my staff was big, and growing.

-

What was going on was this: I was branding my product to look big. Dominating. Well-funded. Growing. Of course, I’m not sure if butchered names from a 1987 gym class serving as employee apparitions was ethical, but my purpose and intention was clear: I wanted to look big and act small.

· Chapter 41 - Throw Hijackers to the Curb!

page 303:

- Providing great customer service is one thing; getting employees to deliver it is another. When you shift your focus to the bottom line, often the frontline is sacrificed. How much is that untrained $8/hr. front desk person with a bad attitude really costing you? To make customers disciples of your business, employees have to share your customer service philosophy. You can’t let any employee ruin a multimillion dollar investment. All the intangibles in the world can’t change a poor customer service experience.

12.4.2. 304:

- First, employees must deliver your customer service philosophy. Your people are ambassadors of your business and they communicate your vision. They’re business chauffeurs, and if they’re reckless, your vision is destroyed. Your employees drive the public’s perception of your company.

· Chapter 42 - Be Someone’s Savior

page 308:

- Forget about your competition 95% of the time. The other 5% should be used to exploit their weaknesses and differentiate your business. If you forget about your competition, you’re forced to focus on your business, which is to innovate and win over the hearts and minds of your customers. And when you fill needs and your army of customers grows, something suddenly happens: Everyone follows you.

· Chapter 43 - Build Brands, Not Businesses

page 311:

- The first step at building a brand is to have a Unique Selling Proposition or a USP. As a business without one, you’re adrift in a sea of me-too businesses without a rudder, unmoored to the trade winds of the marketplace. USP-less businesses offer nothing distinct, nothing unique, no benefit, no logical reason that someone should buy from them other than hope or circumstance wrapped around a cheap price. Your USP is the anchor to your brand. What makes your company different from the rest? What sets your business apart? What will compel a customer to use you over someone else?

page 312:

- USPs should use powerful action verbs that create desire and urgency. “Lose weight” should be changed to “Obliterate fat” or “Shred pounds.” “Grow your business” should be dropped in favor of “Explode revenues” or “Shatter sales records.”

page 314:

- There are five ways to get your message above the noise:

- Polarize

- Arouse emotions

- Be risqué

- Encourage interaction

- Be unconventional

page 317:

- As consumers, we buy things to solve needs. We engage in transactions to fill voids. You don’t buy a drill; you buy a hole. You don’t buy a dress; you buy an image. You don’t buy a Toyota; you buy reliability. You don’t buy a vacation; you buy an experience. We must become problem solvers, and to identify our business as a savior to someone, we must translate features into benefits.

page 318:

-

If you want to sell anything, translate features to benefits. A four-step process accomplishes this.

- Switch places.

- Identify features.

- Identify advantages.

- Translate advantages into benefits.

-

First, trade places with your typical buyer. Be them. Who are they? What is their modus operandi? Are they affluent CEO types? Or price-sensitive Wal-Mart shoppers? Cash-strapped students? Or single moms? If you can’t identify your typical buyer, your results will be flawed and your benefit will be no benefit. Once you identify your buyer, ask: What do they want? What do they fear? What problem do they need solved? Or do they just want to “feel” something?

· Chapter 44 - Choose Monogamy Over Polygamy

- Focus on one business, not many. Once you exit for $50 million, then you can invest in multiple companies (like the venture capitalists do).

· Chapter 45 - Put It Together: Supercharge Your Wealth Plan

page 326:

- To start your Fastlane financial road trip strap on the F-A-S-T-L-A-N-E S-U-P-E-R-C-H-A-R-G-E-R, which is an acronym for the Fastlane process.

- Formula

- Admit

- Stop and Swap

- Time

- Leverage

- Assets and Income

- Number

- Effection

- Steer

- Uncouple

- Passion and Purpose

- Educate

- Road

- Control

- Have

- Automate

- Replicate

- Grow

- Exit

- Retire, Reward, or Repeat